Tax Form eConsent

On an annual basis, per the IRS, UNM must issue all employees a Form W-2 and a Form 1095-C.

Your Form W-2 is what you need in order to file your tax return. The Form 1095-C is provided to all employees eligible for medical insurance benefits, and it is your proof that UNM has offered you these medical benefits (whether you have a medical plan through us or not).

In the past, UNM used USPS mail to deliver these forms to you on paper. Starting with the 2019 forms, employees were given the option to receive them electronically through LoboWeb. For an employer to provide them electronically, the IRS requires that you consent to such electronic delivery; otherwise, UNM will be required to mail your tax forms to your address on file.

What Are The Benefits of Electronic Tax Forms?

- It is secure. Access your forms through LoboWeb, and you will be required to pass through the multi-factor authentication system. There is no risk that these forms containing your social security number can be stolen from your mailbox.

- Get your forms sooner. Electronic access means your forms will be available as soon as UNM has them ready. You do not have to wait for the USPS mailing process to occur.

- Easy access. You can access your forms anytime from any web-accessible device. Still need it in paper? The forms are available in PDF so you can print them as needed.

- It is cheaper. Save the University money by reducing mailing costs and costs associated with returned mail that has to be sorted and mailed again after much research for new addresses is conducted.

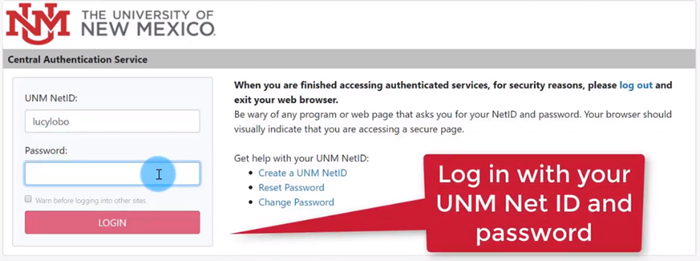

How To Complete Your eConsent or Verify Your Previous Designation |

|---|

Watch Lucy Lobo's eConsent process in this helpful video! |

Frequently Asked Questions

- If I opt in for electronic distribution now, will I receive all my future tax forms the same way?

Yes, as long as you continue to work for UNM, and do not revoke your consent, your eConsent designation will remain in place. - Can I receive my tax forms both electronically and via the mail?

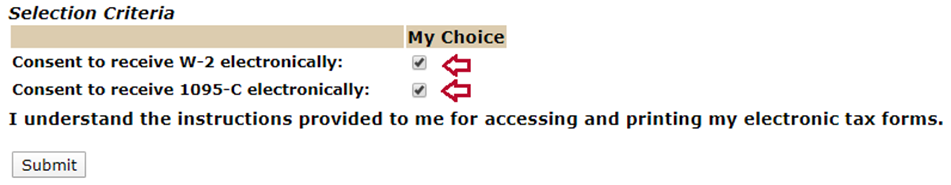

No. To save on costs, UNM will honor one or the other. As mentioned, the electronic receipt requires your consent per the IRS; but remember, you can still print your forms as needed. - If I want electronic delivery of my tax forms, do I have to eConsent for both forms?

Yes. All employees of the University will have a checkbox to consent for electronic delivery of the Form W-2. Please note the consent to the 1095-C is selectable, but does not guarantee you will receive one. Only individuals who are enrolled in a medical plan or are full-time according to the Affordable Care Act regulations, will receive a Form 1095-C. - What if I still want to receive my tax forms via USPS mail?

You will want to keep your checkboxes unchecked in LoboWeb. UNM can’t require you to opt in for electronic distribution, so if you do not elect it, your forms will continue to be mailed to you through USPS. - When will I receive my tax forms?

If you opt in for electronic delivery, your tax form(s) will be made available annually by the end of January or early February. If you choose to receive a form via USPS mail, it will likely arrive near the beginning of February. Communications will be sent each year regarding the specific delivery dates. - What is a Form 1095-C?

The Affordable Care Act requires UNM to offer health insurance coverage to full-time employees, certain “full-time equivalent or FTE employees,” and their dependents. The Internal Revenue Service requires UNM to mail or electronically provide an annual statement Form 1095-C to all employees eligible for coverage describing the insurance available to them. Eligible employees who decline to participate in UNM’s medical insurance plans will also receive a 1095-C. You are not required to attach your 1095-C to your tax return, but do need to keep it with your tax records.

Already eConsented? Here is how you can access your forms when they are ready

Accessing your Form W-2

- Go to my.unm.edu, log in and click Enter LoboWeb.

- Select Tax Forms, then W-2 Wage and Tax Statement.

Or, if you prefer to use the tiles in MyUNM:

- Click the tab that applies to you – Staff, Faculty, or Student.

- Select the tile LoboWeb (Employees) and then LoboWeb Main Menu.

- Log in, select Tax Forms, then W-2 Wage and Tax Statement.

After logging into LoboWeb, you must pass through a multi-factor authentication process, UNM’s second layer of security that protects your sensitive employee information.

- You must decide if you want a text message or a call with a code that you will input to login.

- After authentication, click the Tax Year drop-down and select the year you want to view. Click on Display to see your Form W-2.

- You may print your W-2 to a PDF via the Printable W-2 button found on the bottom left corner of your screen.

Accessing your Form 1095-C

- Go to my.unm.edu, log in and click Enter LoboWeb.

- Select Tax Forms, then 1095 Employer-Provided Health Insurance Offer and Coverage Statement.

Or, if you prefer to use the tiles in MyUNM:

- Click the tab that applies to you – Staff, Faculty, or Student.

- Select the tile LoboWeb (Employees) and then LoboWeb Main Menu.

- Log in, select Tax Forms, then 1095 Employer-Provided Health Insurance Offer and Coverage Statement.

After logging into LoboWeb, you must pass through a multi-factor authentication process, UNM’s second layer of security that protects your sensitive employee information.

- You must decide if you want a text message or a call with a code that you will input to log in.

- After authentication, click the Tax Year drop-down and select the year you want to view. Click on Display to see your Form 1095-C.

- You may print your 1095-C to a PDF via the Printable 1095-C button found on the bottom left corner of your screen.

Print Instructions

Browser Type:

- Internet Explorer on Windows: set all Margins to .5 and remove Page Setup for Headers & Footers

- Chrome on Windows: set Left and Right Margins to .2 and remove Page Setup for Headers & Footers

- Mozilla/Firefox on Windows: set Left and Right Margins to .2 and remove Page Setup for Headers & Footers

- Safari on Macintosh: set Left and Right Margins to .2 and remove Page Setup for Headers & Footers

We do not support Internet Explorer on Macintosh. If submitting a copy to the IRS with your tax return, you may need to trim the printed page to include only the form along with the form name and year at the bottom of the printed form.

Misalignment in box 12 and/or Box 14 on Form W-2 can be caused by the Font/Text Size setting in your browser. You may need to adjust the Text Size setting to a smaller value in your Browser to reformat the alignment. This does not affect the printable or printed W-2 form and is only a display issue.

Contact Us

For Form W-2 questions or assistance, contact Payroll at pay@unm.edu or call 505-277-2353.

For Form 1095-C questions or assistance, contact Benefits at HRBenefits@unm.edu or call 505-277-6947.